For example, acompany could perform work in one year and not receive paymentuntil the following year. Under the cash basis, the revenue wouldnot be reported in the year the work was done but in the followingyear when the cash is actually received. Accrual accounting is an accounting method that records revenues and expenses before payments are received or issued.

The Downside to the Accrual Method of Accounting

It records expenses when a transaction for the purchase of goods or services occurs. The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized. The cash method provides an immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses. If you are using an accounting software, you should look at the setups and accrual to cash journal entry ensure that everything is set properly moving forward so that recording of transactions are not going to be on a cash basis anymore. Don’t think that the software is going to do the work for you in the conversion though, it’s highly likely that it will be a full manual process involving a lot of adjusting journal entries. Accrual accounting is the preferred method according to generally accepted accounting principles (GAAP).

When is it appropriate for a business to change its accounting method from cash to accrurl basis?

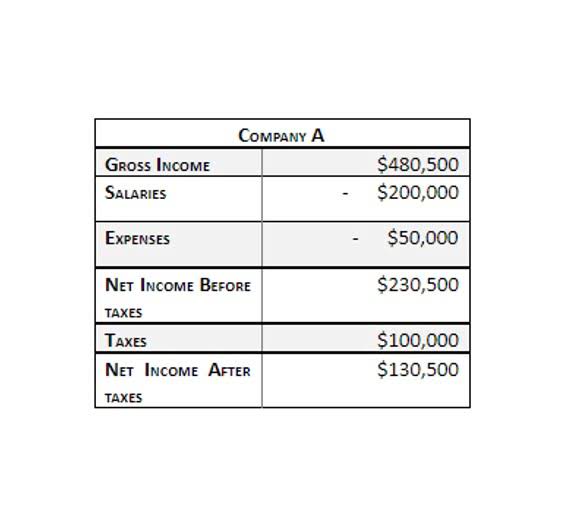

For newer or very small businesses, staying profitable is of great concern. Knowing exactly how much cash is available helps determine when bills get paid or how quickly. In the following month the cash receipts and payments are recorded in the accounting records and an income statement produced at the end of January would appear as follows.

Exploring Accrual Accounting Principles

Most small businesses use a cash-basis accounting system, but the IRS may only allow you to move if your company is structured in a certain way. For instance, you cannot use the cash-basis accounting for the businesses that manufacture, purchase, or sell physical products. Corporations, partnerships, and QPCs are all eligible to employ cash-basis accounting with the IRS so long as they meet specific requirements. This adds expenses which were paid in the current period but relate to a future period and have not yet been incurred.

Is cash accounting in accordance with GAAP?

- Under the cash basis method, the consultant would record an owed amount of $5,000 by the client on Oct. 30, and enter $5,000 in revenue when it is paid on Nov. 25 and record it as paid.

- In our case, if we didn’t get paid immediately, we had already provided a benefit to our customer by selling him $1,000 in goods.

- Another example would be a company that sells goods blended with services.

- However, the cash basis method might overstate the health of a company that is cash-rich.

- Additionally, accrual-basis accounting offers a complete and accurate picture that cannot be manipulated.

- This chart lists all accounts used in a company’s general ledger, including assets, liabilities, equity, revenue, and expenses.

- Accruals are revenues earned or expenses incurred that impact a company’s net income on the income statement but cash related to the transaction hasn’t yet changed hands.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- If the money from sales comes in after the designated term ends, write off all accounts receivables.

- These two widely used accounting methods differ in the way they record business transactions.

- Whenever a company pays in advance for items that represent expenses in the future, a prepaid expense arises.

- Examples of typically encountered accruals and deferrals journals are shown in our accrued and deferred income and expenditure journals reference post.

- Ensuring compliance with GAAP and the IRS will provide a more accurate representation of your business’s financial position.

- Likewise, if an expense is incurred it is only recognized when cash is paid.

Switch to cash basis accounting method – Eligibility

- This method is commonly used by small businesses, as it makes managing cash flow quite simple.

- It’s beneficial to sole proprietorships and small businesses because, most likely, it won’t require added staff (and related expenses) to use.

- This article explores how cash and accrual accounting work, their benefits and disadvantages, the best software tools for each option and which accounting method works best for what types of businesses.

- Under accrual accounting, you record revenues when they are earned, regardless of when cash is received.

- Once the payment is received in cash and the transaction is complete, the journal entries would be adjusted accordingly.

- The remaining sum represents the profit made during the specified time frame.

The cash basis method of accounting recognizes income when it is received and expenses when they are paid. This means that income is recognized when cash is received and not when it is earned. Likewise, if an expense is incurred it is only recognized when cash is paid.

The expense would be recorded regardless of whether the consultant had received their expected cash payment for their delivered services. Accrued revenue is defined as goods or services provided to a customer, however, the company has not yet received payment in cash. We help that this article helped you in your process of understanding accrual to cash conversions. For more articles like this be sure to check out our dedicated accounting and Chartered Financial Analyst (CFA) pages.

What Is the Journal Entry for Accruals?