The ratio is important because it signals to internal management and external investors whether the company will run out of cash. The quick ratio also holds more value than other liquidity ratios, such as the current ratio, because it has the most conservative approach to reflecting how a company can raise cash. The higher the quick ratio, the better a company’s liquidity and financial health, but it is important to look at other related measures to assess the whole picture of a company’s financial health. Current assets are assets that can be converted to cash within a year or less. It includes quick assets and other assets that might take months to convert to cash.

Ask Any Financial Question

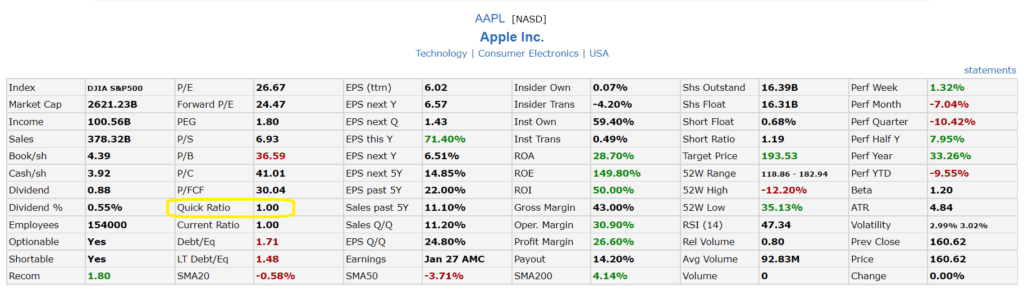

Pretty much any payable you have will be a current liability. Cash equivalents are assets that can be quickly converted into cash, such as short-term investments or accounts receivable. Determining what constitutes a “good” quick ratio can be subjective—it largely depends on industry standards and the specific circumstances of the company. However, a quick ratio of 1.0 is generally considered good, indicating that the company has as much in its most liquid assets as it owes in short-term liabilities. The interpretation of the quick ratio can provide key insights into the financial stability of a company.

Current ratio vs quick ratio: What’s the difference?

Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.These articles and related content is provided as a general guidance for informational purposes only. Accordingly, Sage does not provide advice per the information included. These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. This article and related content is provided on an” as is” basis. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content.

Quick Ratio or Acid Test Ratio FAQs

- Compared to other calculations that include potentially illiquid assets, the quick ratio is often a better true indicator of short-term cash capabilities.

- The quick ratio has the advantage of being a more conservative estimate of how liquid a company is.

- Ideally, most companies would want to have a quick ratio of 3 or higher.

- But also has $1,500 in quick assets, so its quick ratio is 1.5, or $1,500 / $1,000.

- It is a more stringent measure of a company’s liquidity compared to the more commonly used Current Ratio.

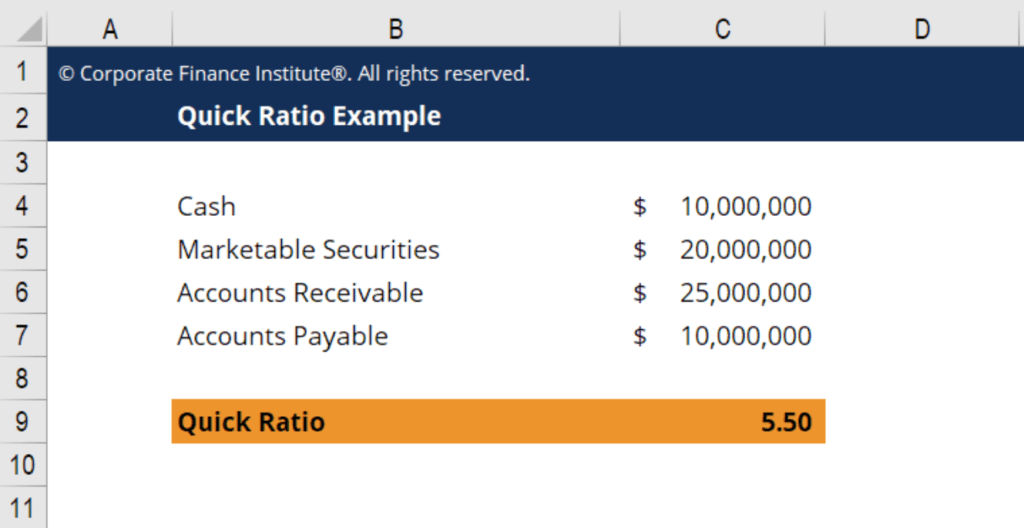

It can help reassure creditors and therefore interest rates they may charge could be lower compared to other companies with lower ratios. The quick ratio is calculated by taking the sum of a company’s cash, cash equivalents, marketable securities, and accounts receivable, and dividing it by the sum of its current liabilities. The Quick Ratio and the equipment leasing the ultimate guide for small business owners Current Ratio are two essential metrics for evaluating a company’s financial health and liquidity. While they share the same objective of assessing a company’s ability to meet its short-term obligations, they do so in slightly different ways. Understanding the distinctions between these two ratios is vital for a comprehensive financial analysis.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The data below was obtained from Fine Trading Company’s balance sheet. Publicly traded companies may report the quick ratio figure under the “Liquidity/Financial Health” heading in the “Key Ratios” section of their quarterly reports. It’s advisable to calculate the Quick Ratio regularly, such as quarterly or annually, to monitor changes in liquidity over time.

Q. How does the Quick Ratio differ from the Current Ratio?

Each component plays a crucial role in determining the quick ratio, offering insights into the company’s liquidity status. The financial metric does not give any indication of a company’s future cash flow activity. Though a company may be sitting on $1 million today, the company may not be selling a profitable product and may struggle to maintain its cash balance in the future. Paying off current liabilities reduces the denominator in the Quick Ratio calculation, which can increase the ratio and improve liquidity. Lenders and creditors often use the Quick Ratio to assess a company’s liquidity and determine its creditworthiness.

More specifically a quick ratio of 1 (or 100%) demonstrates that the value of the most liquid assets an entity has equal to its obligations due in less than one year. Did you know that data in the annual report also allows you to calculate profitability ratios, such as the return on equity and assets? What if we tell you there are tools that indicate the profits you could make versus the risk you are assuming? Check the Sortino ratio calculator for that kind of insight. The ideal liquidity ratio for your small business will balance a comfortable cash reserve with efficient working capital.

The quick ratio comprises quick assets and current liabilities. Quick assets are assets a company expects to convert to cash in 90 days or less. Current liabilities are obligations the company will need to pay within the next year. Remember, the quick ratio is calculated using current assets (excluding inventory) and current liabilities listed on the balance sheet.

In practical business scenarios, quick ratios are invaluable. They help creditors assess a company’s ability to repay a loan, assist potential investors in understanding a company’s financial health, and provide insights for internal decision-making processes. The quick ratio provides a stricter test of liquidity compared to the current ratio. The quick asset includes cash and short-term investments such as marketable securities, Accounts Receivable, prepaid expenses and inventory (if any). Current assets include cash, Accounts Receivable, inventories and short-term investments. The quick ratio or acid test ratio is a firm’s ability to pay its liabilities.