That’s especially important as a outcome of deductions and credits can enhance your tax refund or cut back the amount of taxes you owe. Depending in your submitting status, you may be topic to a limit in your deductions based mostly overfitting and underfitting in ml on your AGI which often applies to greater earnings earners. While AGI is your gross income minus changes, MAGI is your AGI with sure deductions added again.

Adjusted Gross Earnings Vs Gross Income Vs Taxable Income

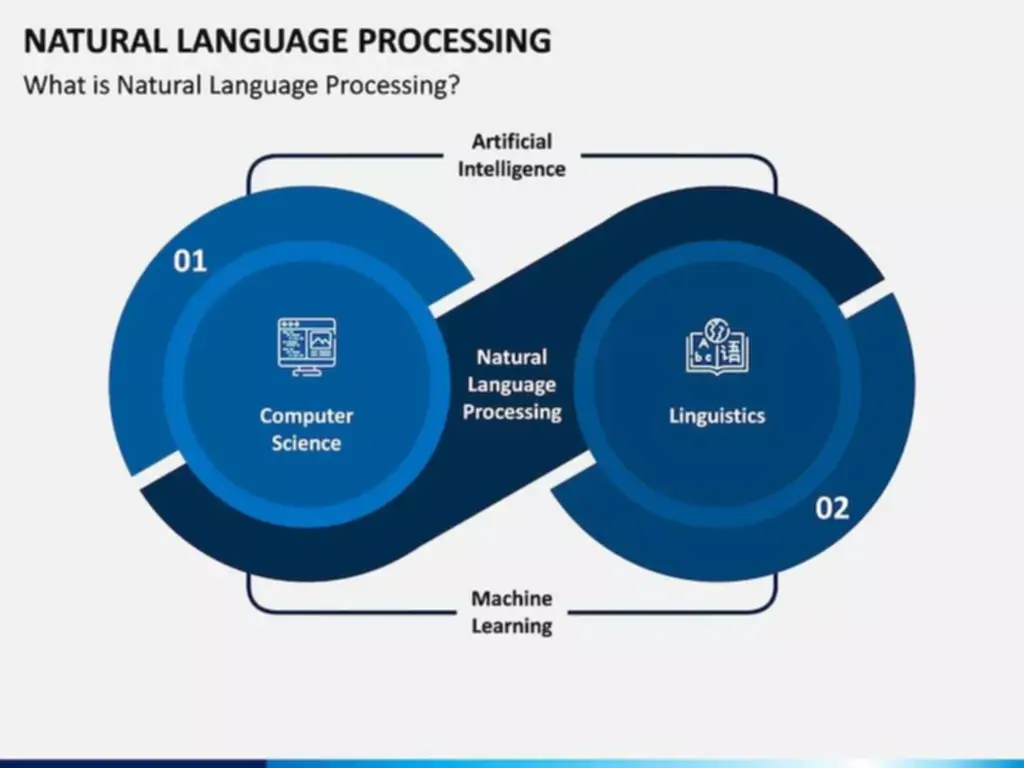

While a priest at Google was convinced, many AI consultants think about this to be a much less rational belief. Based on what’s publicly known concerning the algorithm, GPT-4 does not need to be alive any greater than your TI-89 calculator yearns to inhabit a human form. Even if you would have bother drafting a listing of hyper-specific words, are you able to identify incorrect answers in the above lists? Understanding the distinction between human intelligence and machine intelligence is becoming essential because the hype surrounding AI crescendoes to the heavens. AGI requires AI systems to interact physically with the external setting.

What Is Agi, And How Do I Calculate It?

It performs a pivotal role within the realm of taxes, influencing how a lot you owe or are refunded. Many, or all, of the products featured on this page are from our advertising partners who compensate us whenever you take certain actions on our website or click on to take an action on their web site. We imagine everybody ought to have the ability to make monetary decisions with confidence. If you file electronically, the IRS kind will ask you in your earlier year’s AGI as a way of verifying your identification.

Popular Tax Credits And Magi Ranges For 2023 Tax 12 Months

The chatbot-robot combo would not be capable of obtain a lot independently, even with the most effective robots obtainable right now. A main, limiting factor in the field of robotics is a lack of knowledge. The internet brims with text to improve chatbots; the data obtainable for robotics is less comprehensive. Efforts to build AGI techniques are ongoing and encouraged by emerging developments.

Agi Limits For 2023 Tax Credit

Let’s say you’re a common contractor, however you additionally personal a few rental properties. When you’re calculating your AGI, you’d want to incorporate your wages out of your job in addition to any lease funds you obtain in your rental properties. For all their impressive capabilities, nevertheless, their flaws and dangers are well-known amongst customers at this level, that means they still fall short of fully autonomous AGI. AGI should theoretically have the ability to perform any task that a human can and exhibit a range of intelligence in different areas with out human intervention. Its performance ought to be pretty a lot as good as or better than people at fixing problems in most areas.

- No dialog about adjusted gross income is complete with out discussing modified adjusted gross earnings, or MAGI.

- AGI ought to theoretically have the flexibility to carry out any task that a human can and exhibit a range of intelligence in different areas with out human intervention.

- Artificial intelligence analysis is focused on these techniques and what may be possible with AGI sooner or later.

- These deductions ought to be subtracted out of your whole gross income.

- Because the IRS adjusts these yearly for inflation, your 2023 tax bracket (paid in 2024) could also be completely different from the tax bracket you can expect for 2024 taxes (paid in 2025).

Adjusted gross earnings, also called (AGI), is defined as complete revenue minus deductions, or “changes” to income that you’re eligible to take. Your MAGI determines how a lot, if anything, you can contribute to a Roth particular person retirement account (Roth IRA) in any given yr. Pre-tax contributions to conventional 401(k) funds assist to cut back your AGI and MAGI taxable revenue. Roth IRA contributions are made with after-tax dollars and will not further scale back your AGI or MAGI.

Knowing the method to calculate your adjusted gross revenue precisely is crucial should you plan on claiming tax credits and deductions. Your AGI is essential for tax calculation because it determines your taxable revenue, which is used to calculate how much you owe in federal taxes. It also impacts your eligibility for so much of tax deductions and credits, such because the Child Tax Credit, the Earned Income Tax Credit, and deductions for medical bills. Additionally, your AGI can influence your tax bracket and the entire amount of taxes you pay at the state stage. Once you have your adjusted gross earnings, you should use that quantity to find out your taxable income by taking either the standard deduction or itemizing to further cut back your liability. Your AGI can also assist you determine which tax credits may have the power to prevent money.

When it’s time to calculate your tax bill, understanding your adjusted gross revenue (AGI) is an important first step. If you file your tax return online (or have your tax preparer do it), you’ll want your AGI from the earlier tax year to show your identification to the IRS. In addition, your AGI determines your eligibility for a spread of tax breaks that would decrease your tax bill. With many credit, including the Child Tax Credit, you may only be eligible for a partial credit score based mostly in your AGI.

While you can’t discover AGI on the W2 your employer despatched you, you’ll use your Form W-2 to help calculate AGI. The payer will ship you a Form 1099 to doc these type of miscellaneous funds. Gross income is the total earnings from an organization that features all income and sources of revenue. Net income, sometimes known as internet earnings, is the total gross revenue minus all expenses, taxes, and deductions. Gross revenue is higher than web earnings and consists of whole income or income, whereas internet income refers to web earnings after all expenses, taxes, and deductions are taken out. In addition to getting used to verifying your id, your AGI impacts lots of the tax deductions and credit you presumably can take at tax time.

The very first thing you want to figure out is how much you make before any changes. This isn’t as simple as looking at your W-2 to see your wages, ideas, and other compensation. “It would take off by itself and redesign itself at an ever-increasing fee. Humans, who are restricted by gradual organic evolution, could not compete and can be outmoded.” Definitions of AGI differ as a result of consultants from different fields define human intelligence from completely different views. Computer scientists often define human intelligence in phrases of being able to achieve targets. Psychologists, however, often outline general intelligence by means of adaptability or survival.

You’re allowed to claim an itemized deduction for the portion of those expenses that exceed 7.5% of your AGI. Ella Vincent is a personal finance author who has written about credit score, retirement, and employment points. She enjoys going to live shows in her native Chicago and watching basketball. The physical world is advanced to navigate, and robots succeed solely at very narrowly outlined tasks. A bot might find a way to roam a building site, but it might wrestle to take away the lid from a container.

Artificial basic intelligence is likely one of the forms of AI that will contribute to the eventual growth of synthetic superintelligence. With TurboTax Live Full Service, a local professional matched to your unique scenario will do your taxes for you start to finish. Or, get limitless help and advice from tax experts while you do your taxes with TurboTax Live Assisted. And if you would like to file your individual taxes, you can nonetheless really feel assured you will do them proper with TurboTax as we guide you step by step. No matter which method you file, we guarantee 100% accuracy and your maximum refund.

Depending in your definition of AGI, they might even be able to consciously grasping the meaning behind what they’re doing. Contributing to a retirement account can lower your AGI since these contributions are often deductible. Lower AGI can scale back your tax burden and could make you eligible for extra deductions and credit.

She explains that lots of these questions round AGI are less technical and more value-driven. “It’s most unlikely to be a single event the place we check it off and say, ‘AGI achieved,’” she says. Even if researchers agreed in the future on a testable definition of AGI, the race to construct the world’s first animate algorithm might never have a clear winner.

Achieving AGI requires a broader spectrum of applied sciences, knowledge, and interconnectivity than what powers AI fashions at present. Creativity, perception, learning, and reminiscence are important to create AI that mimics complex human conduct. There is not any further tax credit score for filers with four or extra qualifying youngsters.

Transform Your Business With AI Software Development Solutions https://www.globalcloudteam.com/ — be successful, be the first!