We’ll assume that your company issues a bond for $50,000, which leads to it receiving that amount in cash. As a result, your business posts a $50,000 debit to its cash account, which is an asset account. It also places a $50,000 credit to its bonds payable account, which is a liability account. The income statement is one of a business’s most important financial statements. It shows a company’s revenues and expenses over a period of time and its net income or loss.

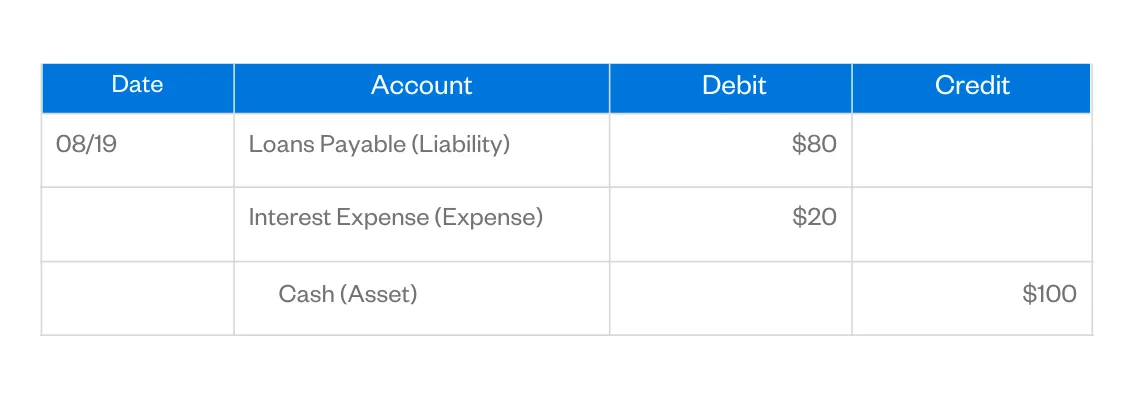

Accounting journal entry example

The highlighted green on assets and expenses shows an increase in assets and expenses. Highlighted green on Liabilities, Capital, and income show a decrease. The equity account on the balance sheet is a record of the equity that the owners have in the company. An expense account is a record of all the money that a company has spent on operating costs. This includes things like rent, salaries, marketing costs, and travel expenses.

Debits and Credits (Explanation Part

Review activity in the accounts that will be impacted by the transaction, and you can usually determine which accounts should be debited and credited. The debit increases the equipment account, and the cash account is decreased with a credit. Asset accounts, including cash and equipment, are increased with a debit turbotax online balance. On the bank’s balance sheet, your business checking account isn’t an asset; it’s a liability because it’s money the bank is holding that belongs to someone else. So when the bank debits your account, they’re decreasing their liability. When they credit your account, they’re increasing their liability.

Debits and Credits Cheat Sheet

Our Explanation of Debits and Credits describes the reasons why various accounts are debited and/or credited. For the examples we provide the logic, use T-accounts for a clearer understanding, and the appropriate general journal entries. By recording both aspects of the transaction, double-entry bookkeeping provides a complete picture of how the purchase affects the company’s financial position. This method ensures accuracy and helps maintain the integrity of the financial records.

- AI-driven systems analyze financial patterns and provide valuable insights for decision-making.

- Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles.

- On February 2nd, the company collected $2,350 for advertising services.

- Keep an eye out for fraudulent charges and make all of your payments on time.

- It can also help you reconcile your bank accounts, generate financial reports, and keep track of expenses without all the manual work.

- Interest earned by a bank is considered to be part of operating revenues.

Understanding Debits and Credits

Drawings represent withdrawals made by the owner from the business for personal use. For example, the business owner withdrew $1,000 cash for personal expenses. This refers to cash received from customers for previous sales made on credit. For example, received $500 cash from a customer who purchased goods on credit.

Prior to publication, articles are checked thoroughly for quality and accuracy. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. This graded 40-question test measures your understanding of the topic Debits and Credits. Discover which concepts you need to study further and enhance your long-term retention. This graded 20-question test measures your understanding of the topic Debits and Credits. This graded 30-question test measures your understanding of the topic Debits and Credits.

Forget the days of dusty ledgers and endless columns of numbers. Let’s dive into how modern technology is revolutionizing the world of debits and credits. For most of my career, I have kept a sticky note on my laptop with a reminder of how debits and credits work. Pass our 40-question exam to demonstrate that you have mastered debits and credits, double-entry, and the accrual method of accounting. As you use the AccountingCoach materials to prepare for the exam, you will gain a deeper understanding.

You can earn our Debits and Credits Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium debits and credits materials. These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. This evolution will streamline accounting tasks, improve audit capabilities, and foster more data-driven financial management.

Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping. In double-entry, each transaction affects two accounts (hence the word double) where one is debited and the other credited. In this guide, we will answer all of these questions, along with everything else you need to know about debit and credit for your small business accounting. Liabilities, equity, and revenue increase with credits and decrease with debits. Debits boost your asset accounts because they represent a gain in resources. For example, if you stock up on new inventory, more resources are coming into your company.