Cynthia Gaffney has spent over 20 years in finance with experience in valuation, corporate financial planning, mergers & acquisitions consulting and small business ownership. A Southern California native, Cynthia received her Bachelor of Science degree in finance and business economics from USC. On the Date of Payment, you would make an entry to debit Stock Dividends Distributable and credit the Common Stock account.

What affects the amount of dividends?

With this journal entry, the statement of retained earnings for the 2019 accounting period will show a $250,000 reduction to retained earnings. However, the statement of cash flows will not show the $250,000 dividend as it has not been paid yet; hence no cash is involved here yet. For corporations, there are several reasons to the entry to adjust the accounts for salaries consider sharing some of their earnings with investors in the form of dividends. Many investors view a dividend payment as a sign of a company’s financial health and are more likely to purchase its stock. In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator.

Dividends Declared Journal Entry

The financial advisability of declaring a dividend depends on the cash position of the corporation. In addition, stock dividends transfer a part of retained earnings to permanent capital. This is referred to as capitalizing retained earnings and makes that part of retained earnings transferred to permanent capital unavailable for future cash dividends.

Large stock dividend

- It is important to consult with a qualified tax professional for more information about how dividends will affect your personal taxes.

- In effect, after the stock dividend, each individual shareholder owns the same proportionate share of the corporation as he or she did before.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

- The difference is the 18,000 additional shares in the stock dividend distribution.

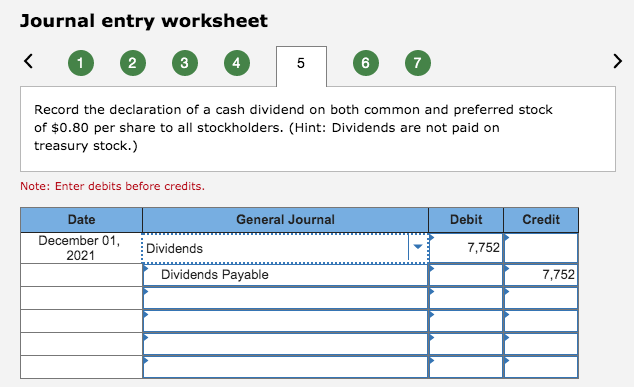

Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. However, sometimes the company does not have a dividend account such as dividends declared account. This is usually the case in which the company doesn’t want to bother keeping the general ledger of the current year dividends. To illustrate, assume that Duratech Corporation’s balance sheet at the end of its second year of operations shows the following in the stockholders’ equity section prior to the declaration of a large stock dividend. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid.

The Journal Entries

The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value. The date of record determines which shareholders will receive the dividends. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. As a stock dividend represents an increase in common stock without any receipt of cash, it is recognized by debiting retained earnings and crediting common stock.

Example of the Accounting for Cash Dividends

Hence, the company needs to make a proper journal entry for the declared dividend on this date. At the time dividends are declared, the board establishes a date of record and a date of payment. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. The date of payment is the date that payment is issued to the investor for the amount of the dividend declared.

When a company declares a stock dividend, the par value of the shares increases by the amount of the dividend. Declaration date is the date that the board of directors declares the dividend to be paid to shareholders. It is the date that the company commits to the legal obligation of paying dividend.

The first date is when the firm declares the dividend publicly, called the Date of Declaration, which triggers the first journal entry to move the dividend money into a dividends payable account. The second date is called the Date of Record, and all persons owning shares of stock at this date are entitled to receive a dividend. This does not require any journal entry, but many investors, especially short-term hold or day-trading investors, want to know this date so that they can buy the stock, receive the dividend and then sell the shares. Similar to the stock dividends, some companies may directly debit the retained earnings on the date of dividend declaration without the need to have the cash dividends account. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends.

A percentage of profits can be paid as dividends, and a percentage can be reinvested back into the business. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Retained earnings are the increase in the firm’s net assets due to profitable operations and represent the owners’ claim against net assets, not just cash.

Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future.

A stock split is much like a large stock dividend in that both are large enough to cause a change in the market price of the stock. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record.