Let’s say a person’s credit rating is actually lower, a lender you will observe among their handmade cards was maxed away or there clearly was a top utilize in line with their borrowing from the bank. In the event this person pays off their charge card each month, they may enhance their get by paying it off till the prevent of the declaration years. An excellent lender’s credit score design prefers to pick a zero harmony more than a beneficial maxed-aside credit card given that amount of borrowing from the bank used versus the amount of credit offered try a significant factor.

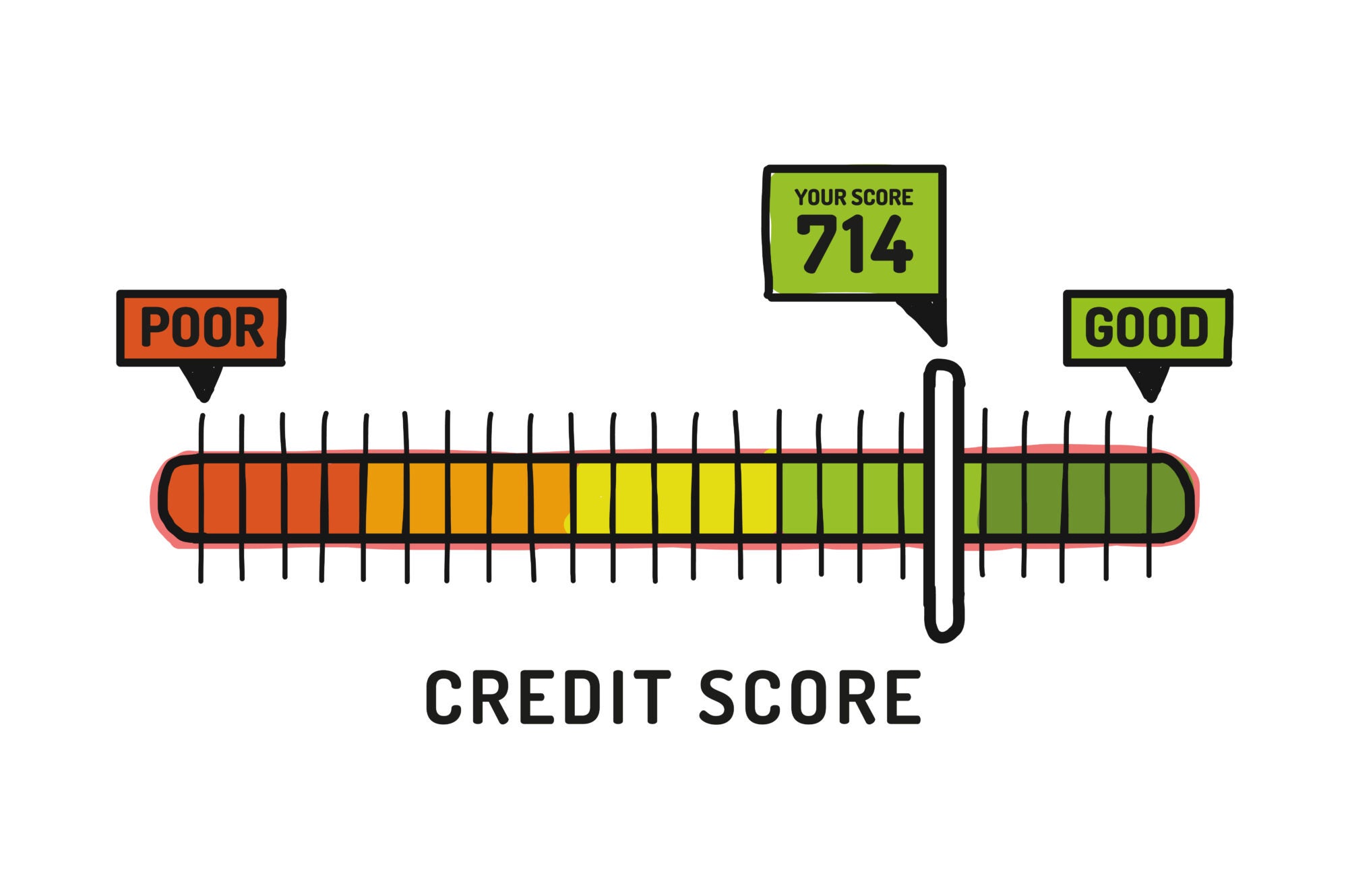

- Payment Record (35%)

- Credit Utilization (30%)

- Duration of Credit rating (15%)

- Borrowing from the bank Combine (10%)

- Brand new Borrowing from the bank (10%)

To advance the newest example, the financing cards member gets a beneficial ding for making use of 95% of the offered credit. A few a means to solve this dilemma and you will enhance their borrowing manage be pay it back before it is due otherwise pose a question to your charge installment loan companies in Augusta ME card company to boost your own credit limit. This would lessen the need speed.

What’s the d?

The new d also provides flexible financing, so it demands as little as ten% to help you 0% off. To have medical professionals taken from studies, whom possibly haven’t got the opportunity to save your self to possess an all the way down percentage but really, this is exactly an appealing option. If you have the amount of money, however, prefer to generate an urgent situation finance, dedicate for advancing years or pay down particular student debt, you can nevertheless get a property and no money off. Long lasting downpayment, there isn’t any financial insurance, that will help save on their monthly payment. This method plus lets medical professionals so you’re able to qualify using future earnings. Whenever you are finishing education and you’ve got a different reputation undertaking contained in this 60 days of the time, you could potentially qualify with your upcoming earnings.

Only to examine, a normal mortgage requires the consumer to pay for individual financial insurance rates (PMI) if they set-out lower than 20 percent of one’s residence’s purchase price. A traditional loan along with requires the access to newest money to help you qualify and you can matters student loan financial obligation, because d allows independency with regards to qualifying that have its education loan payments.

For a physician otherwise a dental expert (MD, Do, DMD, DDS) exactly who qualifies with the program, a doctor loan tends to be a solution to get otherwise refinance your property. The attention pricing, independency, and you can underwriting during the good d could offer great features to people trying re-finance otherwise buy a property.

What exactly is mortgage insurance?

Financial insurance rates handles the lender when the they are incapable of create your mortgage payments, that will somewhat boost your payment. If you are attending set out less than 20% of the property rate, you will be at the mercy of expenses financial insurance coverage.

If you decided to choose a traditional financing an effective $400,one hundred thousand family, that have 10% down, you’ll has home loan insurance rates in the $two hundred to help you $250 per month. Whereas such more financial insurance fees dont exists during the a great physician mortgage system.

Why do mortgage pricing fluctuate?

Rates are tricky, but to supply the easiest answer, finance companies was competitors facing both. You could compare it to buying a stock where rates fluctuate according to the markets. Similarly, energy pricing vary because of supply and you may depend, plus the time of the year. For the most part, one bank that provides an identical unit, its rates are pretty similar to both. There is gonna be days where that lender can be cost a small just before various other due to the fact financial is attempting to help you participate by providing your a loan at best price.