Deciding whether or not to use the guarantee of your house to pay off unsecured debt and you will/otherwise generate renovations would be an emotional monetary decision. The chance of lowest annual fee prices and you will streamlined monthly payments helps make next mortgage loans most attractive. However, utilizing your domestic to possess guarantee try a decision that should be weighed cautiously.

Household Collateral Mortgage otherwise Domestic Security Line of credit (HELOC)

They often provide higher interest levels than just no. 1 mortgage loans once the financial assumes higher risk. In case there is foreclosure, an important financial might possibly be reduced before every second mortgage loans.

Yet not, because the mortgage has been collateralized, interest levels to possess next mortgages are often lower than simply typical personal debt for example credit cards, playing cards, and you will consolidation money.

Additional big benefit of next mortgage loans is that at least a few of the focus is, having individuals exactly who itemize, tax-deductible. For a full taxation benefit, the complete obligations on your own household–such as the home security financing–dont meet or exceed the business property value our home. Consult with your taxation coach to own information and qualification.

Are another home loan wise?

Prior to deciding which type of next financial is perfect for you, basic know if you actually need you to. When you yourself have ongoing expenses products, using the equity of your house might not help and may also, actually, getting damaging. Ponder the following:

- Might you appear to fool around with playing cards to pay for family costs?

- If you deduct the costs out of your money, can there be a shortage?

- If you were to pay-off your creditors making use of the equity of your home, create around end up being a powerful possibility of taking on much more personal debt?

For people who answered yes to almost any of before questions, scraping out of the equity of your house to settle user debt could be a short-name services which can place your home in jeopardy of foreclosure.

If you utilize brand new collateral of your home to repay your unsecured debts following run-up your own credit cards once more, you may find your self really hard condition: zero house collateral, highest debt, and you may an inability making payments on the both your covered and you will unsecured economic commitments. Paying more than you will be making is never reasonable to use the guarantee of your home.

How can i start-off?

If you have figured using household security is practical, your following action is to see the procedure for acquiring a great second financial and also to select from a property collateral financing and a house guarantee line of credit.

Factors to consider.

A consideration to adopt when looking for an extra home loan are settlement costs, that can include financing affairs and you can app, origination, term research, appraisal, credit assessment, notary and you can legal fees.

Some other choice is whether you want a fixed or adjustable interest rate. If you choose an adjustable speed loan, observe far the speed can alter across the lifetime of the mortgage incase there is certainly a limit you to tend to avoid the speed from exceeding a specific amount.

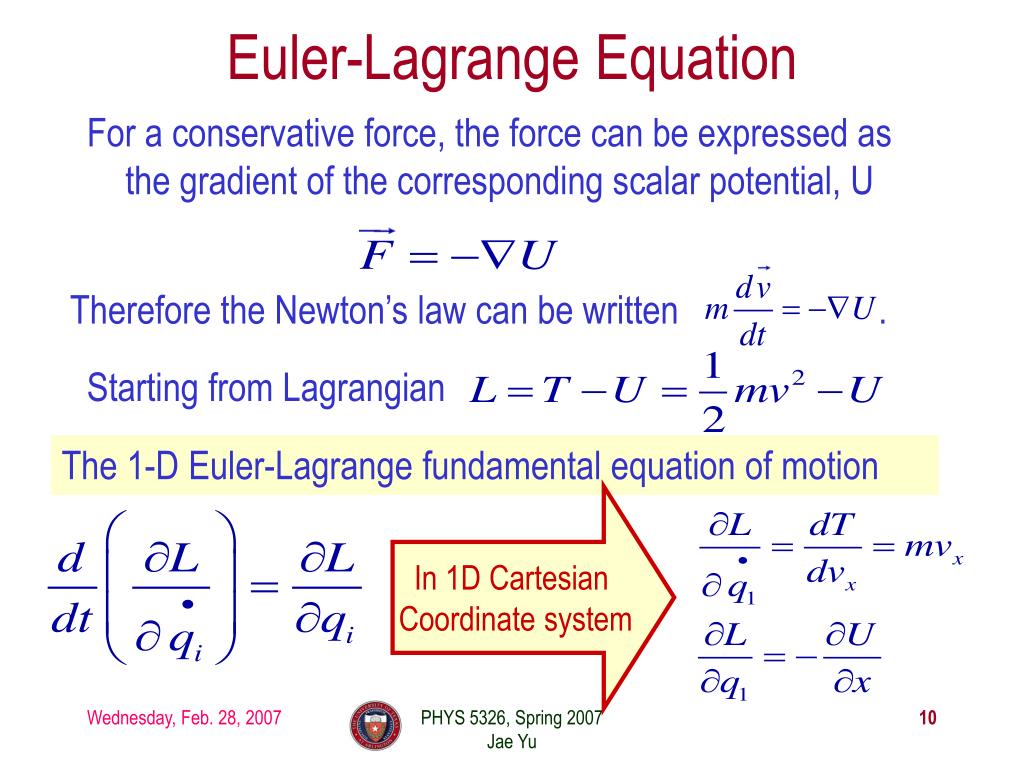

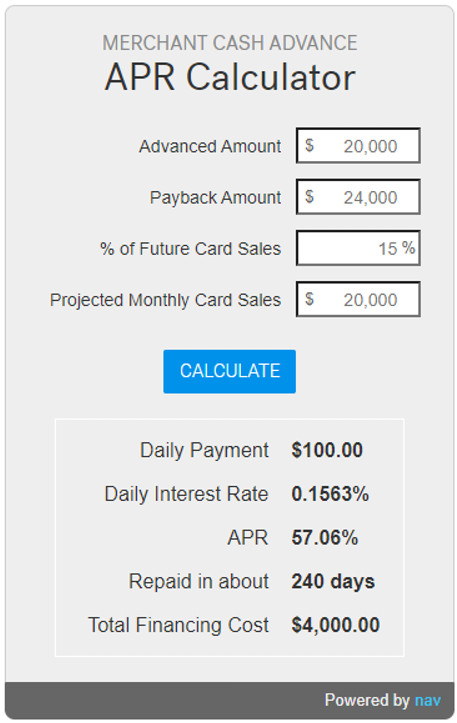

Annual percentage rate (APR).

Shopping around with the lowest Apr (Annual percentage rate) was built-in of having the most from the loan. The Apr getting household equity funds and you may domestic security contours is actually determined differently, and you may side-by-side evaluations will be tricky. To own antique domestic guarantee money, the latest Apr boasts situations or other fund costs, since the Apr for a home guarantee line depends solely on the periodic rate of interest.

Other factors.

Before generally making people decision, get in touch with as much loan providers as possible and examine the new Apr, closing costs, financing terms, and you will monthly obligations. Along with request balloon payments, prepayment punishment, punitive interest levels if there is standard, and you will addition out of borrowing insurance coverage.

When shopping for finance, do not believe in lenders and you will agents exactly who get you query other experts, locals, and you will loved ones to have reliable leads, and you will look into the Sites having quickly available rates.

House Collateral Finance.

With a home collateral financing, loans in Avon you will receive the profit a lump sum when you intimate the borrowed funds. The fresh new installment title is usually a fixed months, usually of five to 20 years. Always, the percentage agenda need monthly installments that can pay-off the whole financing inside the period.

Some lenders ount regarding equity you have got of your home the latest projected worth of our house without count you continue to owe. You aren’t required to borrow a full count but could as an alternative use only what you need.

Rates of interest are often repaired in place of variable. You might consider a house equity mortgage as opposed to a home equity line of credit if you need a set amount to have a specific objective, eg an improvement to your house, or even to repay all of your current unsecured debt.

Family Equity Lines of credit.

Property security line is actually a kind of revolving borrowing from the bank. A specific amount of borrowing from the bank is set if you take a portion of one’s appraised value of the house and you may deducting the balance due with the current financial. Money, costs, other bills, and credit score are factors when you look at the determining the financing range.

Shortly after approved, you are able to obtain as much as that maximum. Small print exactly how money are going to be accessed try outlined on the loan files.

Appeal is usually changeable as opposed to fixed. However, the new installment identity might be repaired incase the expression ends, you will be up against a great balloon fee new unpaid percentage of your loan.

The main benefit of a property security personal line of credit is that you might pull out seemingly short figures occasionally, and attract will simply be billed after you subtract the money. The fresh new drawback is the urge so you’re able to fees indiscriminately.

Be cautious about as well-good-to-be-genuine offers.

You are lured because of the now offers that allow you to use to 120% of your own house’s collateral. Be aware that people desire over the home’s collateral limit is actually perhaps not tax deductible. On the other hand, you won’t have the ability to offer your house up until the lien was found, that will adversely change the marketability of your home.

Finally, for those who suddenly improve your attention, federal legislation will give you three days immediately following finalizing a home collateral mortgage bargain so you can terminate the offer for any reason.