The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted. Whenyou compare the retained earnings ledger (T-account) to thestatement of retained earnings, the figures must match. It isimportant to understand retained earnings is not closed out, it is only updated. RetainedEarnings is the only account that appears in the closing entriesthat does not close.

Discover essential tips to streamline your month-end close process

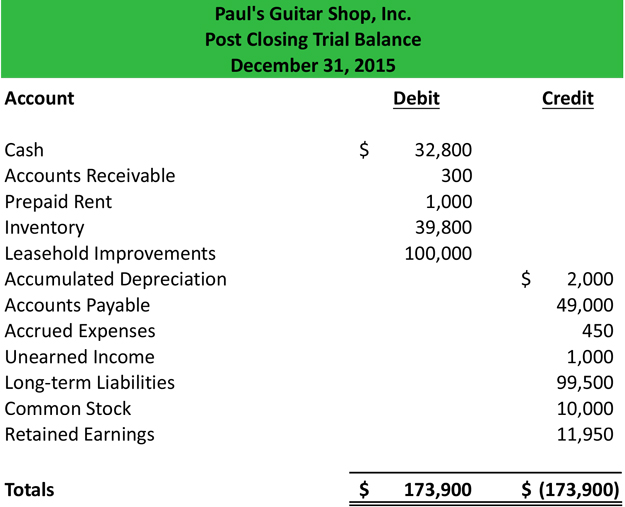

This is no different from what will happen to a company at theend of an accounting period. A company will see its revenue andexpense accounts set back to zero, but its assets and liabilitieswill maintain a balance. In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining. The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings.

Characteristics of Permanent Accounts:

On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. First, all the various revenue account balances are transferred to the temporary income summary account. This is done through a journal entry that debits revenue accounts and credits the income summary. In other words, the closing entry is a method of making repayments on all the costs incurred within a given financial year. To complete, this method involves transfer of funds from revenue-generating accounts such as wages payable and interest receivable to an intermediary account known as income summary.

How to post closing entries?

Lastly, you’ll repeat the process for each temporary account that you have to close. Alright, with a high-level understanding let’s dive into the 4-step close process. These accounts are be zeroed and their balance should be transferred to permanent accounts. Any remaining balances will now be transferred and a post-closing trial balance will be reviewed.

Close income summary account

In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account budget tracker and planner is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the end of the accounting period.

What can I save for the quarter close instead of the month end close?

Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. In this case, if you paid out a dividend, the balance would be moved to retained earnings from the dividends account. Once this has been completed, a post-closing trial balance will be reviewed to ensure accuracy.

We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero.

- This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.

- Also known as real or balance sheet accounts, these are general ledger entries that do not close at the end of an accounting period but are instead carried forward to subsequent periods .

- And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period.

The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’s income statement. Now Paul must close the income summary account to retained earnings in the next step of the closing entries.

Also known as real or balance sheet accounts, these are general ledger entries that do not close at the end of an accounting period but are instead carried forward to subsequent periods . Real accounts, also known as permanent accounts, are quite different compared to their temporary equivalents. They persist from one accounting period to the next and maintain their balances over time unlike temporary accounts which are closed at the end of the period.

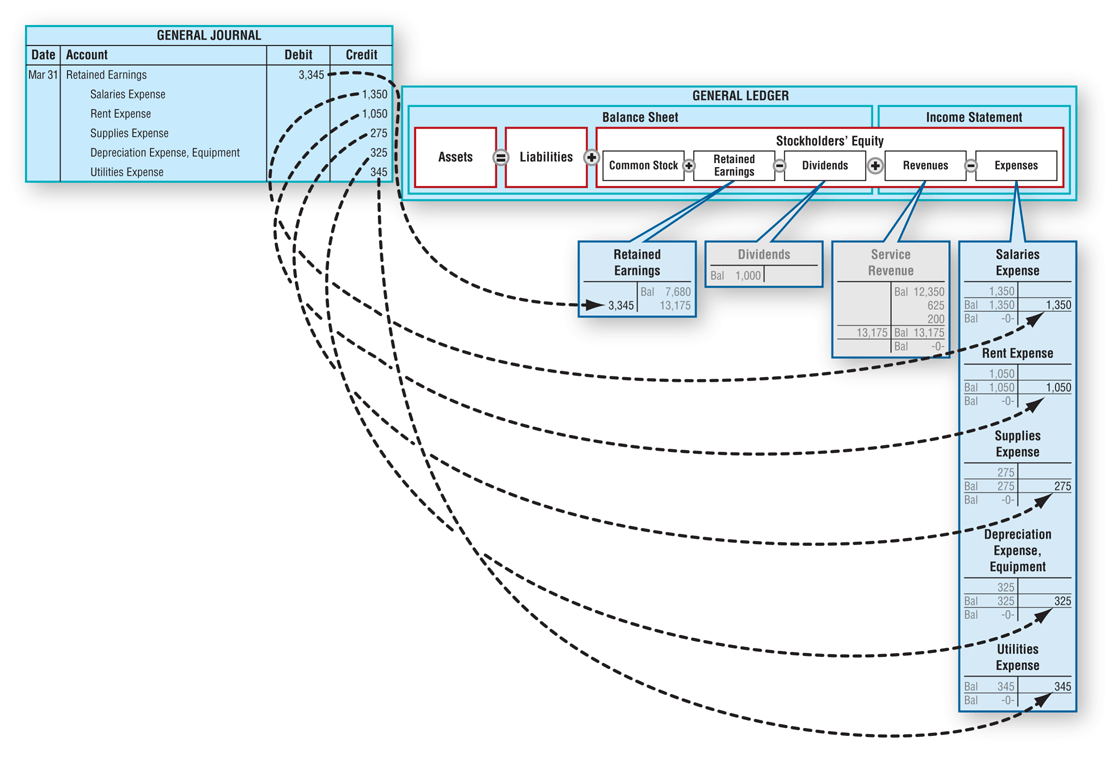

When you make closing accounting entries, you can follow the same steps. We are going to go over these at a high level and then jump into each step individually. The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7.