Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. As long as a business earns a substantial profit on each sale and sustains adequate sales volume, fixed costs are covered, and profits are earned. The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits.

Real-Life Examples of Operating Leverage

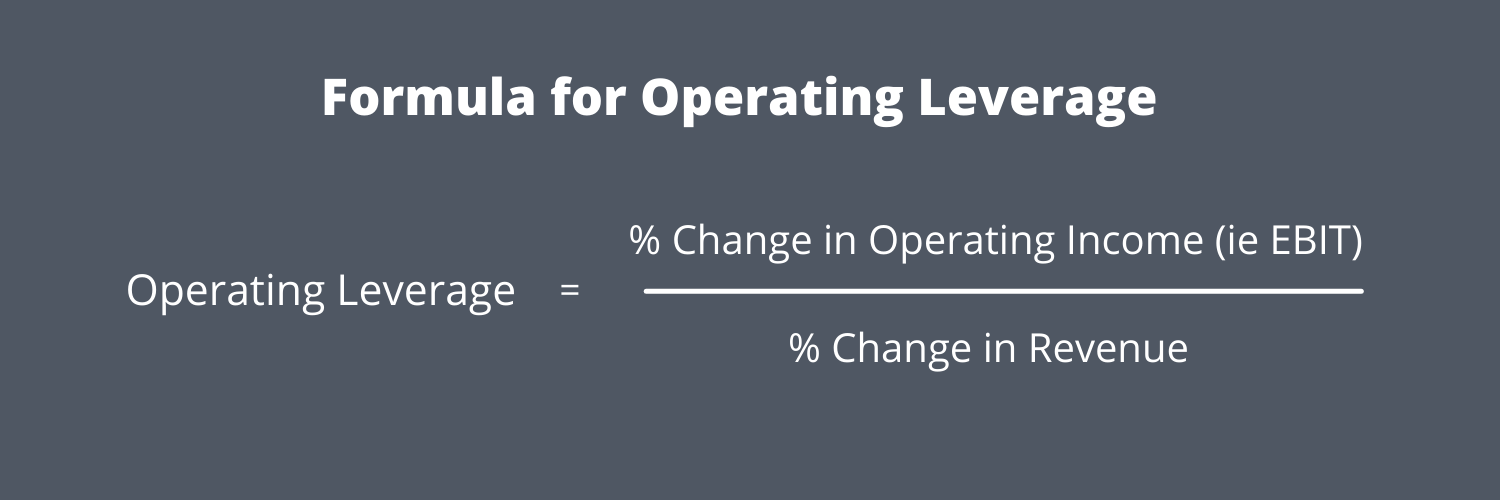

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit. Operating leverage measures a company’s fixed costs as a percentage of its total costs. It is used to evaluate a business’ breakeven point—which is where sales are high enough to pay for all costs, and the profit is zero. A company with high operating leverage has a large proportion of fixed costs—which means that a big increase in sales can lead to outsized changes in profits.

Can DOL be used to compare companies?

We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. The degree of combined leverage gives any business the optimal level of DOL and DOF. Here’s your step-by-step guide to using the Degree of Operating Leverage Calculator. These two costs are conditional on past demand volume patterns (and future expectations).

Example: DOL

The calculation of operating leverage is important because it can determine the appropriate price point for covering your expenses and generating profit. It shows how businesses can effectively use fixed-cost assets like machinery, equipment, and warehousing to generate profit. In addition, if fixed assets gain more profits, operating leverage will improve. The fixed costs are those that do not change with fluctuation in the output and remain constant.

Degree of Operating Leverage Analysis

This tells you that, for a 10% increase in sales volume, ABC will experience a 25% increase in operating profit (10% x 2.5). The current sales price and sales volume is also sufficient for both covering ABC’s $3,000,000 fixed costs and turning a profit as a result of the $10 per unit contribution margin. A corporation will have a maximum operating leverage ratio and make more money from each additional sale if fixed costs are higher relative to variable costs. On the other side, a higher proportion of variable costs will lead to a low operating leverage ratio and a lower profit from each additional sale for the company.

- Conversely, retail stores tend to have low fixed costs and large variable costs, especially for merchandise.

- For a low degree of operating leverage, the short-term revenue fluctuation doesn’t hurt the company’s profitability to a larger extent.

- If the sales increase from 1,000 units to 1,500 units (50% increase), the EBIT will increase from $2,500 to $5,000.

- InvestingPro offers detailed insights into companies’ Degree of Operating Leverage (DOL) including sector benchmarks and competitor analysis.

It will show the sensitivity of company profit and how bad it will go when sales drop. Moreover, DOL also helps management to estimate the number of sales require if they want to increase profit. The impact of the high fixed costs is directly seen in the firm’s ability to manage revenue fluctuations. Regardless of the sales level, the fixed expenses have to be fulfilled. The high operating leverage reflects the inflexibility in managing costs and revenues.

But at the same time, such firms are exposed to fluctuations in economic conditions and business cycles. You can calculate the percentage increase or decrease by 4 transfer pricing examples explained dividing the second year’s number by the first year’s number and subtracting 1. The following information pertains to last week’s operations of XYZ Company.

This ratio is often used when forecasting sales and determining appropriate prices. A higher degree of operating leverage means that a business has a high proportion of the fixed cost. Low operating leverage industries include restaurant and retail industries. These industries have higher raw material costs and lower comparative fixed costs.

It is important to understand the concept of the DOL formula because it helps a company appreciate the effects of operating leverage on the probable earnings of the company. It is a key ratio for a company to determine a suitable level of operating leverage to secure the maximum benefit out of a company’s operating income. The formula is used to determine the impact of a change in a company’s sales on the operating income of that company. But this comes out to only a $9mm increase in variable costs whereas revenue grew by $93mm ($200mm to $293mm) in the same time frame. Next, if the case toggle is set to “Upside”, we can see that revenue is growing 10% each year and from Year 1 to Year 5, and the company’s operating margin expands from 40.0% to 55.8%.