It helps in verifying whether the total debits equal total credits, ensuring that the books are balanced. Once posted to the general ledger, you need to balance all of your business’s transactions. Do this at the end of the accounting period, which can be monthly, quarterly, or annually, depending on the company.

Differences in the accounting cycle for small businesses and corporations

Without the ledger, business owners couldn’t generate reports, prepare financial statements, or analyze the results of their day-to-day operations. The seventh step requires to prepare financial statements including the income statement, balance sheet, Statement of Retained Earnings, and cash flow statement. These statements are helpful and show the company’s current financial position and performance. The accounting cycle is a comprehensive accounting process that begins and ends in an accounting period. It involves eight steps that ensure the proper recording and reporting of financial transactions. Once a company’s books are closed and the accounting cycle for a period ends, it begins anew with the next accounting period and financial transactions.

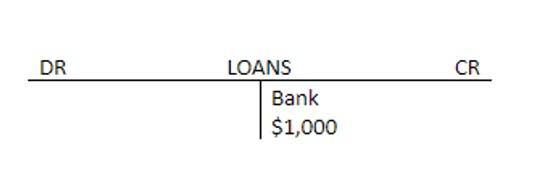

Now, this transaction will affect the Cash and Entertainment account only, where, on the Cash T Account, you will decrease or put his $40 amount on the right side of the T account. For example, if a business sells $25,000 worth of product over the year, the sales revenue ledger will have a $25,000 credit in it. This credit needs to be offset with a $25,000 debit to make the balance zero.

- Balance sheet accounts (such as bank accounts, credit cards, etc.) do not need closing entries as their balances carry over.

- It’s helpful to also note some other details to make it easier to categorize transactions.

- Setting up an effective process and understanding the accounting cycle can help you produce financial information that you can analyze quickly, helping your business run more smoothly.

- This can be a good time to reflect and compare the firm’s performance with other periods and peers.

- Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors.

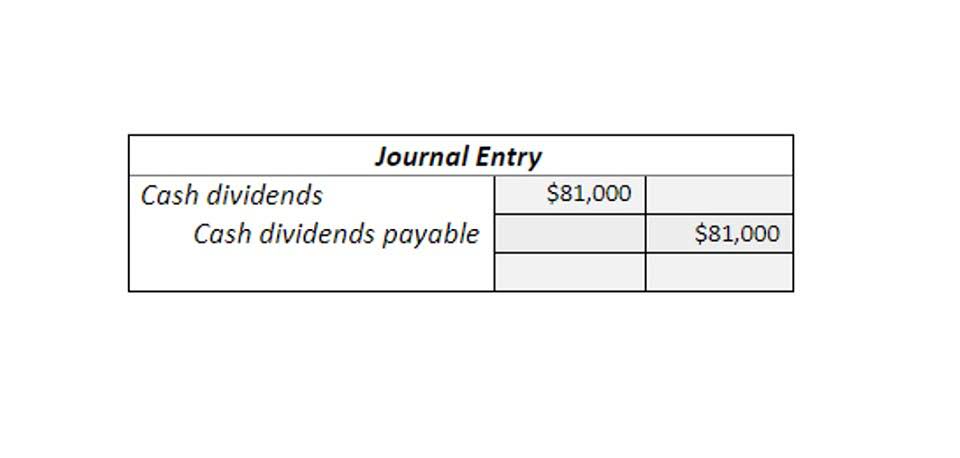

- Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date.

The accounting cycle helps provide relevant financial information to stakeholders, enabling them to make informed decisions about the company’s financial health. The accounting cycle is a cornerstone of financial management, providing a systematic approach to recording and reporting financial data. It ensures that all business transactions are captured, processed, and presented in a way that supports accurate decision-making and regulatory compliance. While the steps of the cycle are procedural, their importance extends far beyond bookkeeping, affecting every aspect of a company’s financial health. Various financial statements such as the income statement, balance sheet, and cash flow statement are generated using the adjusted trial balance. These statements provide a comprehensive view of the company’s financial performance and position.

Revenue vs. Profit: The Difference and When They Matter

Once you make adjusting journal entries, you run a trial balance one more time. This is the adjusted trial balance because it reflects all the adjusting journal entries. If your trial balance doesn’t balance, you need to go back through your transactions to find and correct the error. During the accounting cycle, financial statements such as the income statement, balance sheet, and cash flow statement are generated. The trial balance is essential because it lists all general ledger accounts and their respective debit and credit balances. It helps verify that the total debits equal total credits, ensuring that the books are balanced before generating financial statements.

Step 7: Generating Financial Statements

Fortunately, established processes exist to help businesses and entrepreneurs accurately record and report financial activities. This eight-step repeatable guide is a basic checklist of what to do during each accounting period. All phases are covered, from identifying and recording transactions to checking for discrepancies, making adjustments, and creating financial statements. The post-closing trial balance is prepared after closing entries have been made. It only includes permanent accounts, as temporary accounts have been closed. In contrast, the adjusted trial balance includes all accounts, including temporary accounts, after adjusting entries have been applied.

- Further, with our Smart Chasing feature, you can accelerate the I2C cycle with more efficient, consistent dunning, bringing your bank account and your A/R account into closer alignment.

- Adjustments ensure that your financial statements are accurate and up to date.

- The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business.

- In the final step, temporary accounts (revenue, expense, and dividend accounts) are closed, transferring their balances to the retained earnings account.

- For example, if the IRS flags a tax deduction they deem suspicious, you can easily trace the number back to your ledger to double-check its accuracy and provide support for the write-off.

- The accounting cycle ends with closing the books, typically occurring at the end of a month, quarter, or fiscal or calendar year.

STEP 5: Making adjusting entries

You can then show these financial statements to your lenders, creditors and investors to give them an overview of your company’s financial situation at the end of the fiscal year. A trial balance is an accounting document that shows the closing balances of all general ledger accounts. You need to calculate the trial balance at the end of the fiscal year. The objective of the trial balance is to help you catch mistakes in your accounting. A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated.

Finding Small Business CPAs: Tips Before You Choose

When transitioning over to the next accounting period, it’s time to close the books. Once you’ve created an adjusted trial balance, assembling financial statements is a fairly straightforward task. Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date.

Adjusting entries are made at the end of an accounting period social security and railroad retirement benefits to ensure that revenues and expenses are recognized in the correct period. They address the recognition of prepaid expenses, accrued revenues, and accrued expenses, among other adjustments necessary for accurate financial reporting. In conclusion, compliance and auditing are integral aspects of the accounting cycle that ensure the accuracy, reliability, and transparency of financial reporting. Adhering to accounting standards and regulations enhances the credibility of financial statements and fosters trust among stakeholders.

Auditing, as an independent assessment, provides assurance of the accuracy of financial information and helps identify potential issues that need to be addressed. By recognizing impairment of assets boundless accounting the importance of compliance and auditing, organizations can maintain strong financial governance and make informed decisions based on reliable financial data. A trial balance is a list of all general ledger accounts with their respective debit and credit balances.

Steps of the accounting cycle

Online tools streamline the creation, editing, and sharing of flowcharts. Circle shape with line (sequential data)The circle shape with a line shows where data must be stored in a system sequentially vs. randomly. Tape drives, used for backups, store data sequentially, while laptops use random access memory. Second hexagon (loop limit)The loop limit symbol is a rectangle with angled top corners. Programming workflows use this symbol to identify when a repeating process should end. Rectangle with bottom wave shape (document)The rectangle with the wavy bottom signifies a document within the process.

What should month-end reports contain?

Known as the “trial balance,” this provides insight into the financial health of your company and can help you identify any discrepancies in your bookkeeping. It’s important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported. This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations. A worksheet is a tool that helps you identify specific errors in your records. Using the trial balance, you’ll compile the credits and debits of each of your accounts in a single spreadsheet.

You document sales with invoices, payments with receipts, and adjustments with credits and refunds. Your bookkeeper should “accept” every transaction to ensure that it is accurate and it was purposely placed. For example, when a customer pays $500 to start an annual subscription, it marks the beginning of the accounting cycle.

The 8 Steps in the Accounting Cycle

The accounting cycle ends with closing the books, typically occurring at the end of a month, quarter, or fiscal or calendar year. You pull all the information from the previous steps in the accounting cycle and plug them into a financial statement template. You may also produce an owner’s equity generally accepted industry practices statement, Which shows changes in the value of all equity accounts belonging to the company’s owners or shareholders. Once you close the accounts, you’re ready to restart the accounting cycle for the next fiscal year. For example, you have made an entry where you debited the Entertainment account for $40 and credited cash $40.

If you need to make any adjusting journal entries, you should include a note explaining the adjustment. For example, if you’re adjusting a bill you paid, you’ll make a note to refer to the reconciling bank statement that cites a different amount. There are many transactions throughout a single accounting cycle, and a business has to record each one correctly. Almost all companies use accounting software, so posting transactions to GL is less of a concern now than in the past. Accounting software automatically posts transactions into the GL in real time. Closing entries offset all of the balances in your revenue and expense accounts.

This alignment provides stakeholders with a clear view of the company’s performance and financial position, fostering trust and transparency. These steps might seem intimidating at first, but remember, most businesses use accounting software that handles the entire accounting process for every transaction within moments. During the sorting process, you organize transactions into accounts in an accounting ledger. Those accounts are categorized into assets, liabilities, revenues, expenses, and equity. For example, if the bookkeeper had debited cash by $100 and credited customer A’s account by $1,000, the credit and debit balances wouldn’t match. The bookkeeper will need to change the amount in the journal entry or pass an adjusting entry to fix the error.

Book a demo today to see what running your business is like with Bench.