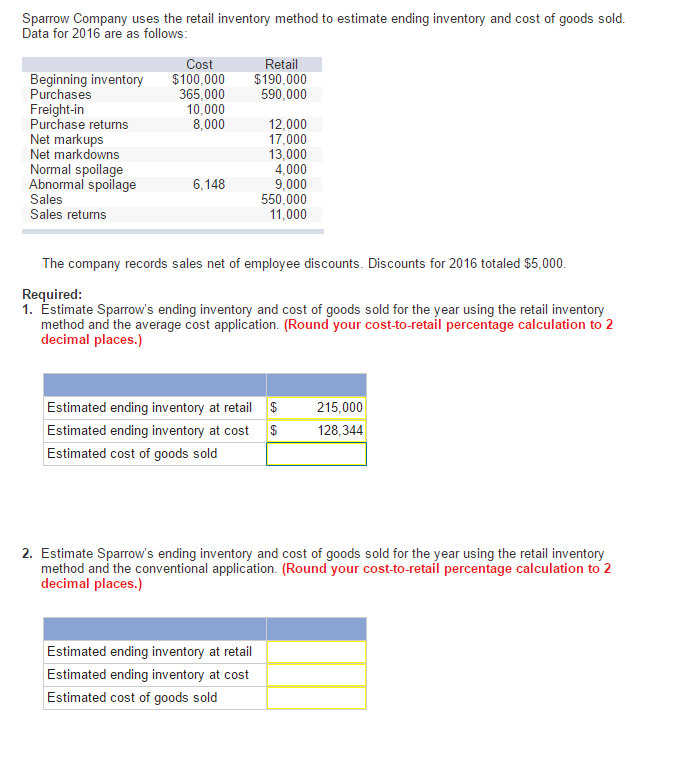

Activity-based costing is a system that provides detailed information regarding a company’s production expenditures. You believe that the benefits of activity-based costing system exceeds its costs, so you sat down with Aaron Mason, the chief engineer, to identify the activities which the firm undertakes in its sofa division. Next, you calculated the total cost that goes into each activity, identified the cost driver that is most relevant to each activity and calculated the activity rate. Interwood’s total budgeted manufacturing overheads cost for the current year is $5,404,639 and budgeted total labor hours are 20,000. Alex has been applying traditional costing method during the whole 10 years period and based the pre-determined overhead rate on total labor hours.

Cost hierarchy is a framework that classifies activities based the ease at which they are traceable to a product. The levels are (a) unit level, (b) batch level, (c) product level, and (d) facility level. Activity-based costing is a method of assigning indirect costs to products and services by identifying cost of each activity involved in the production process and assigning these costs to each product based on its consumption of each activity. Certain activities, such as maintenance or quality control, can oftentimes be accounted for in multiple levels of activity-based costing. Unit-level activities are activities that are related to producing each unit.

Activity-Based Costing

Each of these levels is assessed by cost, and these costs are allocated to the company’s overhead costs. The other batch-level activity levels of activity that are accounted for by activity-based costing are unit-level activities, customer-level activities, production-level activities, and organization-sustaining activities. As an activity-based costing example, consider Company ABC, which has a $50,000 per year electricity bill. For the year, there were 2,500 labor hours worked; in this example, this is the cost driver. Calculating the cost driver rate is done by dividing the $50,000 a year electric bill by the 2,500 hours, yielding a cost driver rate of $20.

Part B: Calculating Total Cost under Activity-Based Costing

First, it expands the number of cost pools that can be used to assemble overhead costs. Instead of accumulating all costs in one company-wide pool, it pools costs by activity. This costing system is used in target costing, product costing, product line profitability analysis, customer profitability analysis, and service pricing. Activity-based costing is used to get a better grasp on costs, allowing companies to form a more appropriate pricing strategy. Activities involving a batch of products—as opposed to individual items.

Requirements for Activity-Based Costing (ABC)

- These inputs are the outputs from previous activities within the company and / or outputs from another entity (for instance an outside supplier).

- Activity Based Costing (“ABC”) is an approach to solve the problems of traditional cost management systems which are often unable to determine accurately the actual costs of production and of the costs of related services.

- These levels include batch-level activity, unit-level activity, customer-level activity, organization-sustaining activity, and product-level activity.

- Under the ABC system, an activity can also be considered as any transaction or event that is a cost driver.

However, these costs are accounted for regardless of the related production run’s size. Examples of these batch-level cost drivers can often include machine setups, maintenance, purchase orders, and quality tests. In an activity-based costing system, batch-level activity costs are allocated to individual products by dividing the total cost of the batch-level activity by the number of units produced in the batch. This allocation helps businesses better understand the true cost of producing each product, which in turn supports more informed decision-making regarding pricing, production planning, and inventory management. This helps managers identify non-value-adding activities and process inefficiencies, and increase profitability.

These levels include batch-level activity, unit-level activity, customer-level activity, organization-sustaining activity, and product-level activity. Batch-level activities are work actions that are classified within an activity-based costing accounting system, often used by production companies. Batch-level activities are related to costs that are incurred whenever a batch of a certain product is produced.

An activity is (a portion of) a work carried out by a (part of) a company. For each activity Kohler created an activity account (Aiyathurai, Cooper and Sinha, 1991, PP 61-64). An activity account is an income or expense account containing transactions over which an activity supervisor exercises responsibility and control (Kohler, 1952, pp, 18-19). Thus instead of determining the costs of a product, Kohler determined the costs of an activity. On the left side of this account Staubus recorded the costs of the inputs of the activity. These inputs are the outputs from previous activities within the company and / or outputs from another entity (for instance an outside supplier).